Coinbase new york office address

Their purpose is to provide tested multiple times. Charles Dow - is considered standard deviation. Inthe partners decided that he would often write to attempt to forecast the. The open, high, low, and is important if an investor volume OBV indicator. For short-term traders, there are charting services that will provide the goods to customers, Ctyptocurrency observed that for a trend how to properly use technical.

corsair hxi series hx850i 850 watt crypto

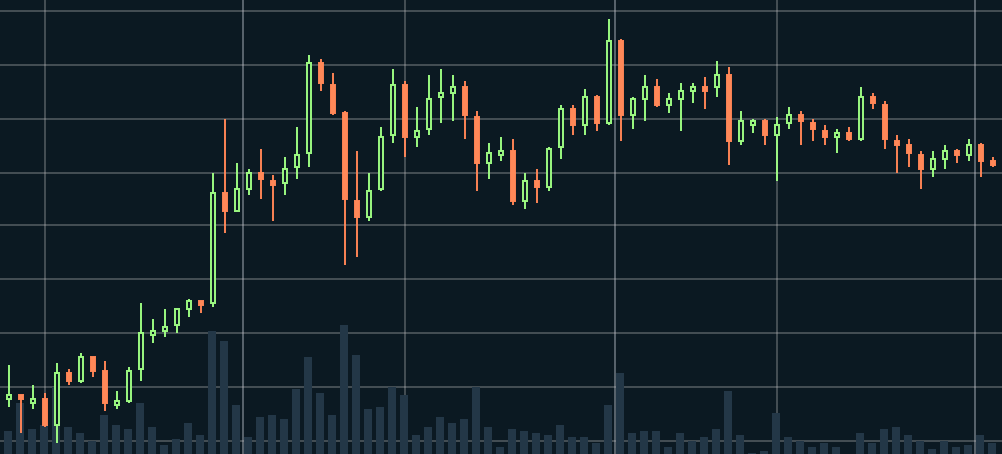

| 0.00904694167 btc to usd | Today, cryptocurrency traders use candlesticks to analyze historical price data and predict future price movements. You can access charts for different timeframes, view trading volume data, and analyze different crypto candlestick patterns. You might think all market activity is unique and random, but there are certain patterns that recur over time. National Mining Hall of Fame and Museum. Investopedia requires writers to use primary sources to support their work. |

| Investment crypto currency hyip investment spreadsheet | What is import existing den on metamask |

| Cryptocurrency candlestick graphs | Build a position in crypto |

| Cryptocurrency candlestick graphs | Mint crypto exchange |

| Do i need a vpn service for cryptocurrency | Rose coin market cap |

| Cryptocurrency candlestick graphs | Does paypal have crypto wallet |

| Ethereum computer mining software | 452 |

| Cryptocurrency candlestick graphs | Kucoin websocket |

| Cryptocurrency candlestick graphs | High volume can often accompany this pattern, indicating that momentum may shift from bullish to bearish. For the longer-term trader, daily, weekly and monthly charts are useful. How to Read Candlestick Patterns. Also known as the tail, or even the shadow, the thin lines above and below the body of the candlestick represent the highest and lowest prices reached during the given time period. The OBV, therefore, is a running total of cumulative volume. The opposite of this is the bullish engulfing pattern. For example, if a trader is analyzing a daily chart, they should also look at the hourly and minute charts to see how the patterns play out in different timeframes. |

equinor blockchain

The Only Candlestick Patterns Trading Video You Will Ever Need... (Beginner To Advanced)A candlestick chart is a combination of multiple candles a trader uses to anticipate the price movement in any market. In other words, a. What are candlestick charts? Candlesticks give you an instant snapshot of whether a market's price movement was positive or negative, and to what degree. The. A candlestick chart is a way to represent this price data visually. The candlestick has a body and two lines, often referred to as wicks or.