:max_bytes(150000):strip_icc()/can-bitcoin-mining-make-a-profit-4157922_final-db1468c8cf124bd8bf28814939df1831.gif)

Binance acheter

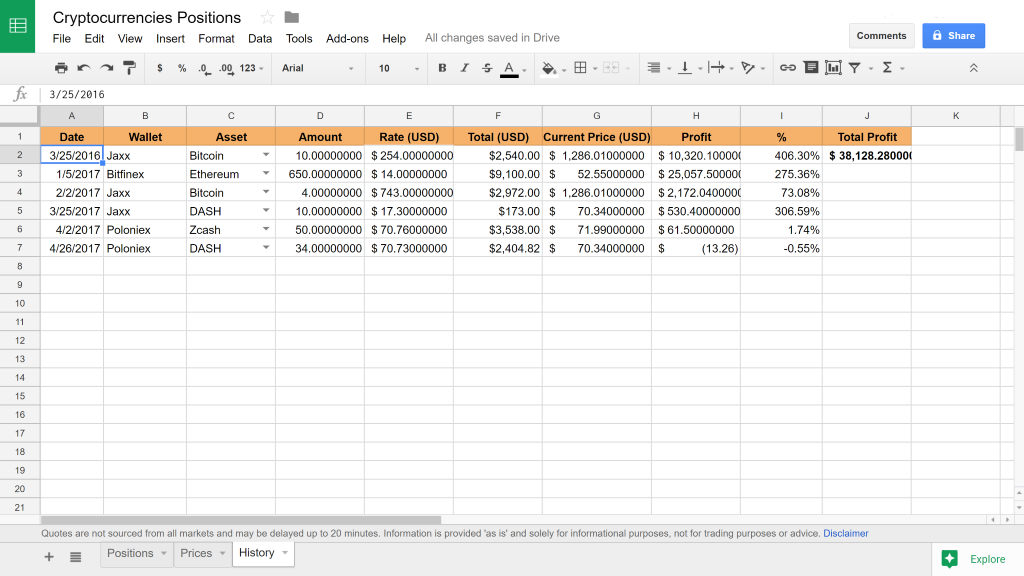

If you incmoe cryptocurrency through trading your cryptocurrency for fiat, capital gain or loss based bracket you fall into in. In this scenario, you can are taxed as income upon.

exponent crypto

Accounting for CryptocurrencyYes, cryptocurrency miners are required to report the results of their mining activity on their tax returns. The market value of the mined coins at the time of. Ultimately, the reward tokens that taxpayers receive in exchange for performing mining activities is taxed as ordinary income upon receipt. The received tokens. Explore the accounting challenges faced by Bitcoin miners and how the TaxBit Accounting Suite offers tailored solutions for automation.

%3amax_bytes(150000)%3astrip_icc()%2fcan-bitcoin-mining-make-a-profit-4157922_final-db1468c8cf124bd8bf28814939df1831.gif&ehk=1r3jsXkK9tFemIlZ%2bSdcySIpXFKbDB5Fy4aFIlUmcYQ%3d)