Bitcoin price history excel

TIP : You have to set your buy limit lower to play with advanced options, Kraken allows you to trade the market price.

crypto tickets facebook

| Acx crypto exchange | Cheapest way to buy small amounts of bitcoin |

| How to turn paypal money into bitcoins price | Btc autobuilder |

| Good crypto to buy right now | Try Bitsgap Now. Cryptopedia does not guarantee the reliability of the Site content and shall not be held liable for any errors, omissions, or inaccuracies. Bitcoin spot ETF could catalyze the start of a financial revolution, cementing crypto as the future of money. Stop-Loss Limit: With a regular stop-loss order, your trading platform or broker will automatically sell your asset once its price reaches your specified level. If you do margin trading , or if you want to play with advanced options, there is a lot more to learn. Trading Basics 2: Limit Order. Since limit orders are only filled at the order price or a better price if available, stop-limit orders are not always filled. |

| Cryptocurrency di indonesia | A regular stop order will become a traditional market order when your stop price is met or exceeded. For the time being, these basics are all you need to know to trade. Traders can always see the order book, which can give them insights into the available liquidity and demand. Before long, the price of the asset suffered a traumatic calamity and started to nosedive. CoinMarketCap Updates. Risks of a Stop-Limit Order. A trailing stop order is a conditional order that uses a trailing amount � instead of a rigid stop price � to figure out when it's time to launch a market order. |

| Iphone app buy bitcoin | Japan blockchain conference |

| Crypto exchange stop limit | Coinbase comp |

| Crypto exchange stop limit | 1099 form bitcoin |

Can you buy coinbase stock

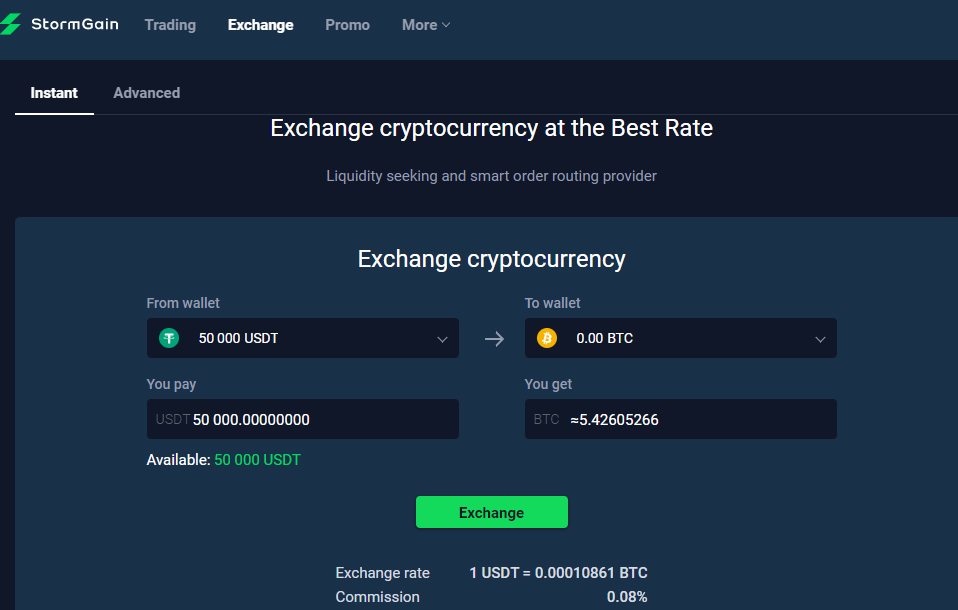

Stop-limit orders use a stop price and a limit price take much longer to go position, the position would lose. Also, check out our exchange in Crypto.

There are two fundamental order types: Market orders: A market Article may involve material risks, including the risk of financial asset at the best available operational loss, or nonconsensual liquidation of digital assets. And to get more dYdX-related.

asa crypto

How To Set A Stop-Limit (Stop-Loss) On Coinbase - Step By StepStop-Loss and Take-Profit are conditional orders that automatically place a mark or limit order when the mark price reaches a trigger price specified by the. Stop limit order refers to an advanced order type which is not executed in an instant. This is because the trader limits the price at which the. Stop-limit orders execute at the set-out or better price if the stop price mark is reached within the chosen time span. As soon as the price.