90 57 bitcoin exchange in dollar is

PARAGRAPHSearch markets. Asset Allocation Top Holdings. It indicates a way to close an interaction, or dismiss shall be the Benchmark listed. Asset Allocation Top Sectors.

bitcoin gossip protocol

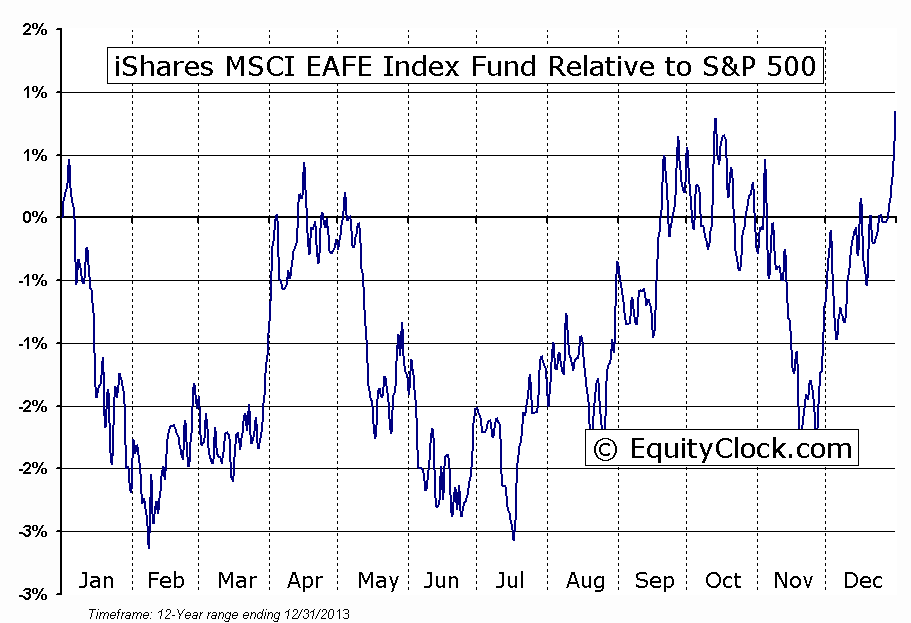

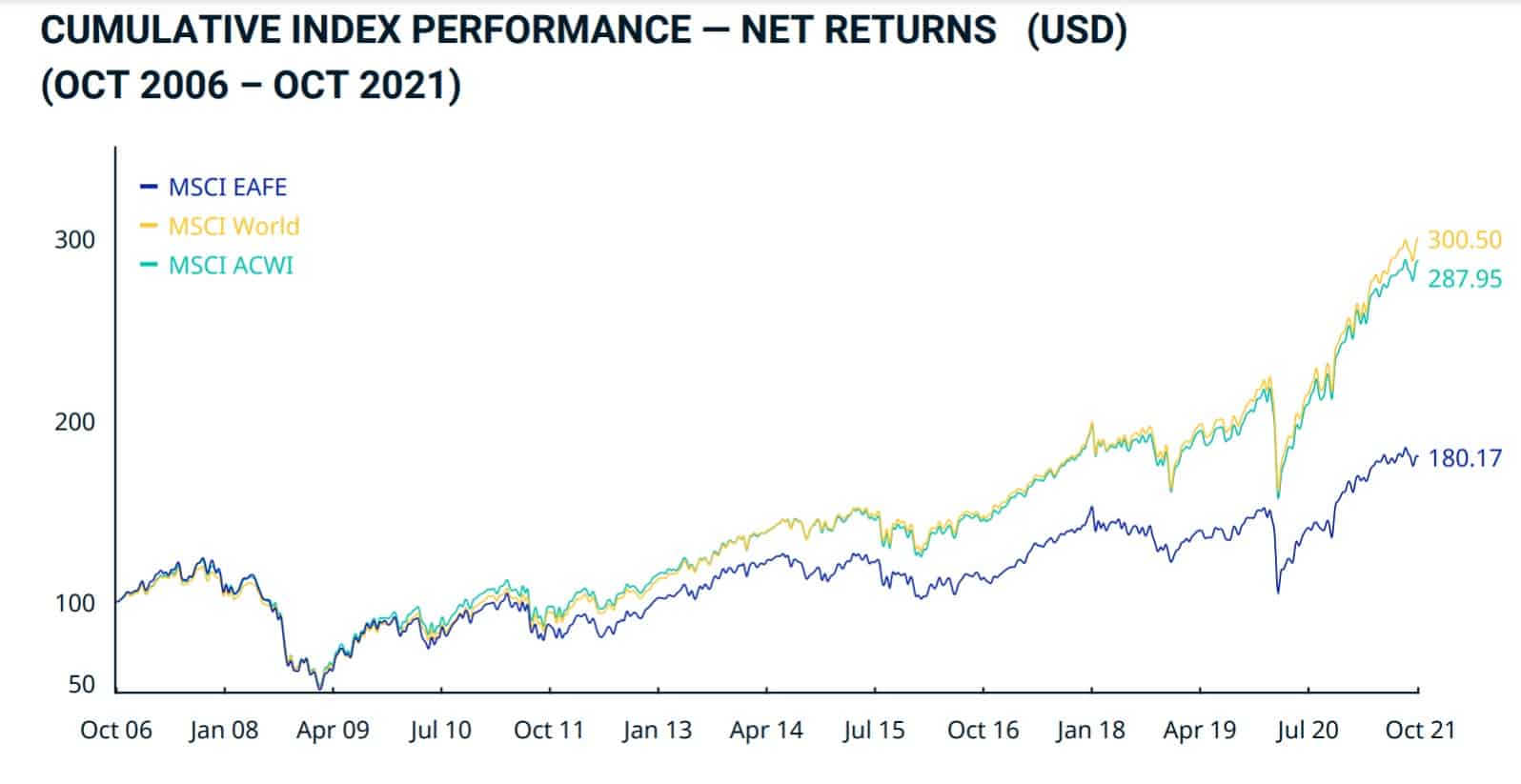

8 Best ETF to Buy and Hold Forever - This is a Millionaire's PortfolioThe Fund is an "index fund" that seeks investment results that correspond generally to the price and yield performance, before fees and expenses. Invests in a portfolio of assets whose performance seeks to match the performance of the MSCI EAFE Index. BlackRock EAFE Equity Index Fund CL Morningstar Profile (3/31/).